Oklahoma Unclaimed Property: How to Find and Claim Your Money For Free!

Are you a resident of Oklahoma? Have you ever thought that you might have unclaimed funds waiting for you to claim? If so, you’re not alone. According to the National Association of Unclaimed Property Administrators (NAUPA), there is over \$42 billion in unclaimed property held by state governments and other organizations across the US.

In this article, we’ll explore the topic of unclaimed funds in Oklahoma. We’ll cover what unclaimed funds are, where to search for them, and how to claim them. We’ll also provide some tips and resources to help you make the most of your search.

What are Unclaimed Property?

Unclaimed funds are assets that have been separated from their rightful owners for an extended period of time. This can happen for a variety of reasons, such as a change of address, a lost or forgotten account, or a deceased family member. Examples of unclaimed funds include:

- Unclaimed bank accounts

- Uncashed checks

- Refunds from utility companies or insurance policies

- Unclaimed wages or pensions

- Safe deposit box contents

How to Search for Unclaimed Property

If you think you might have unclaimed funds in Oklahoma, the first step is to conduct a search. Here are some resources to help you get started:

Oklahoma State Treasurer’s Office

The Oklahoma State Treasurer’s Office maintains a searchable database of unclaimed funds that have been turned over to the state. To search for unclaimed funds in Oklahoma, follow these steps:

- Visit the Oklahoma State Treasurer’s Office website at https://www.ok.gov/treasurer/Unclaimed_Property/index.html

- Click on the “Search for Unclaimed Property” button

- Enter your first and last name in the search box

- Click on the “Search” button

If your search returns any results, you’ll need to follow the instructions provided to claim your funds.

If your search returns any results, you’ll need to follow the instructions provided to claim your funds.

Convenience Other Resources

In addition to the resources listed above, you can also check with the following organizations to see if they are holding any unclaimed funds on your behalf:

- The IRS

- The Social Security Administration

- The Department of Veterans Affairs

- The Pension Benefit Guaranty Corporation

How to File a Claim Unclaimed Funds in Oklahoma

If your search for unclaimed funds in Oklahoma is successful, the next step is to claim your funds. Here’s what you need to do:

- Review the instructions provided with your search results to determine what documentation is required to claim your funds.

- Complete and submit any required forms or documentation.

- Wait for your claim to be processed. This can take several weeks or months, depending on the complexity of your claim.

- If your claim is approved, you’ll receive your funds either by check or direct deposit.

Tips and Resources for Finding Unclaimed Funds in Oklahoma

Here are some additional tips and resources to help you make the most of your search for unclaimed funds in Oklahoma:

- Search for unclaimed funds using variations of your name, such as nicknames or maiden names.

- Check with the state where you last had an account!

Idaho Unclaimed Property

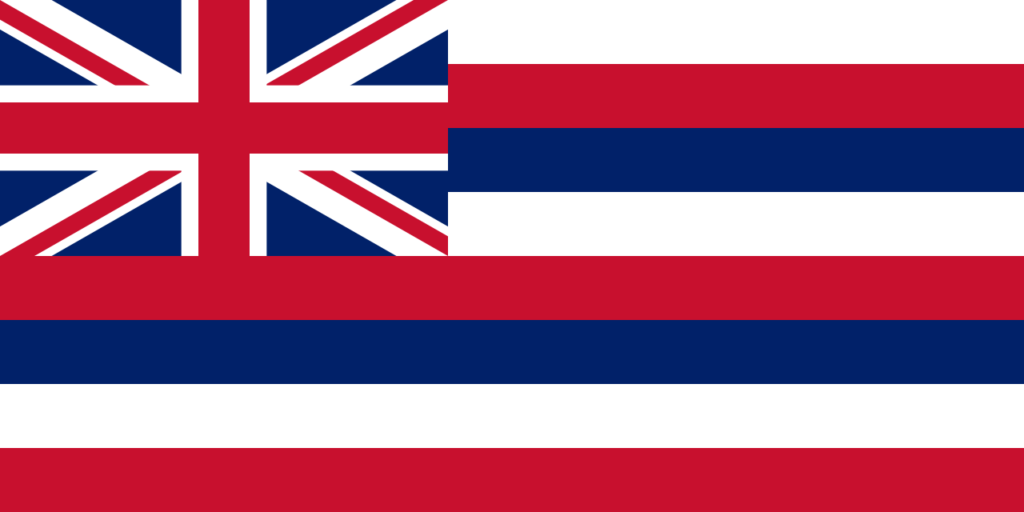

Idaho Unclaimed Property Hawaii Unclaimed Property

Hawaii Unclaimed Property Georgia Unclaimed Property

Georgia Unclaimed Property